|

Create Your Personal Retirement Fund

SUN FLEXILINK + MYFUTURE FUND Sun Life Financial, one of the country's foremost and most trusted brand in the areas of insurance and financial services, offers solutions to help you in your journey toward building up a comfortable Retirement Fund for use in your later years.

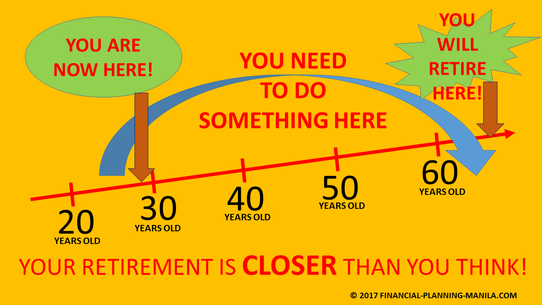

One such Sun Life Solution involves the use of the Sun Flexilink Variable Life Insurance product combined with the Sun Life MyFuture Fund. You're already IN TROUBLE if you don't have a Retirement Plan in place if you're now in your 30s, 40s or 50s.

WE OFFER YOU OUR SOLUTION.

THIS IS HOW IT WORKS. SUN FLEXILINK is THE VEHICLE.

Sun Flexilink is a life insurance policy that is payable for life (if Fund Value is sufficient to pay for all charges). You have the option, however, to shorten the payment period in a manner that is comfortable for you. You can opt to pay:

It gradually builds up a Fund Value over time that can be used to build up your Retirement Fund . To accumulate a sufficient Fund Value, you must apply for a Sun Flexilink AS EARLY AS POSSIBLE. The MYFUTURE FUND grows YOUR MONEY FOR YOU.

My Future Fund is an investment fund that is guided by a target date.

It attempts to build your funds aggressively during the early years then shifts to a more conservative strategy to preserve your money as your target date approaches. THE POWER OF TWO.

WORKING FOR YOU. SUN FLEXILINK + MYFUTURE FUND. This dynamic package secures your family's future with:

To build up your Retirement Fund over time, the investment portion of your money can be placed in one of several MyFuture Funds to aggressively grow your money (by placing them in mostly stocks) during the early years while consolidating and preserving it (by transferring them into mostly bonds and money market instruments) as your target date approaches. You can choose to place the investment portion on any of the following Funds: MyFuture 2025 Fund - if you expect to retire near 2025. MyFuture 2030 Fund - if you expect to retire near 2030. MyFuture 2035 Fund - if you expect to retire near 2035. MyFuture 2040 Fund - if you expect to retire near 2040. Whether you're STARTING OUT...or MOVING UP...or PREPARING AHEAD..or LEAVING A LEGACY, you can be sure that SUN LIFE will be with you

every step of the way. Why You Should Get the SUN FLEXILINK + MYFUTURE FUND Retirement Plan As Early As Possible

The Top Reasons Why All Responsible Individuals Should Build a Retirement Plan AS EARLY AS POSSIBLE.

Because you don't want headaches in trying to find where to get your daily spending money when your earnings have already stopped.

|

"You can be young without money but you can't be old without it!"

A Brighter Life Awaits With SUN LIFE.

Y O U R P A R T N E R

Edwin T. Bartolome

Financial Advisor and Certified Investment Solicitor Sun Life Financial Code # 090848 For assistance in crafting an appropriate Retirement Plan , you may reach him at: Cellphone: 0908-863-4617 and E-Mail: edwinbartolome.sunlife@gmail.com Office Address:

Baobab New Business Office Sun Life Financial 6/F BTTC Centre, 288 Ortigas Avenue Greenhills, San Juan City Philippines Tel. No. 7-719-3958 Fax. No. 7-719-3894 Edwin Bartolome is authorized by the Insurance Commission to act as an Insurance Agent. He is likewise authorized by the Securities and Exchange Commission to act as a Certified Investment Solicitor. SUN LIFE ALSO OFFERS THE FOLLOWING RETIREMENT SOLUTIONS:

|