|

FINANCIAL PLANNING

Financial Planning that's effective and correctly implemented is a major cornerstone of every successful enterprise in any society. Why? Simply because almost all of the resources that enable enterprises to succeed in their endeavors require an adequate and even abundant well of cash and capital.

But how can you ensure that your enterprise can generate an abundant supply of cash and capital? You need to undertake financial planning. Any person, family or organization can be considered an enterprise in the financial sense. So it follows that each and every Filipino need to perform financial planning at all points in his life. Filipinos and Financial Planning

For so long, many Filipinos have been mired in a cycle of perpetual want for monetary resources. It is ironic as Filipinos have been known to comb the length and breadth of the globe to work and earn money for their families' sustenance and well-being. Why then is money so scarce for many? The answer lies in their lack of knowledge (and perhaps lack of patience) on aspects of financial planning. A general aversion to mathematical calculations perhaps? Filipinos in Metro Manila and throughout the nation would benefit immensely if only they conduct financial planning regularly and consistently, whether it be on an individual or family basis. It is a great tool that will enable Filipinos to keep tabs on money coming in and out of their accounts, align these flows with their life goals at various stages of their lives, and successfully achieve these life goals. Steps in Financial Planning Financial planning is a dynamic process that needs to be done on a regular and consistent basis. It usually involves these basic steps:

So don't go through life encountering the same financial problems as our elder generations did.

With all the resources, knowledge and qualified financial advisors to help you, encountering a lack of cash, money and other financial resources to meet certain life goals is no longer excusable. Take charge of your finances today. See how life would be a lot more comfortable if you engage in financial planning NOW. |

"Someone is sitting in the shade today because someone planted a tree a long time ago" Y O U R P A R T N E R

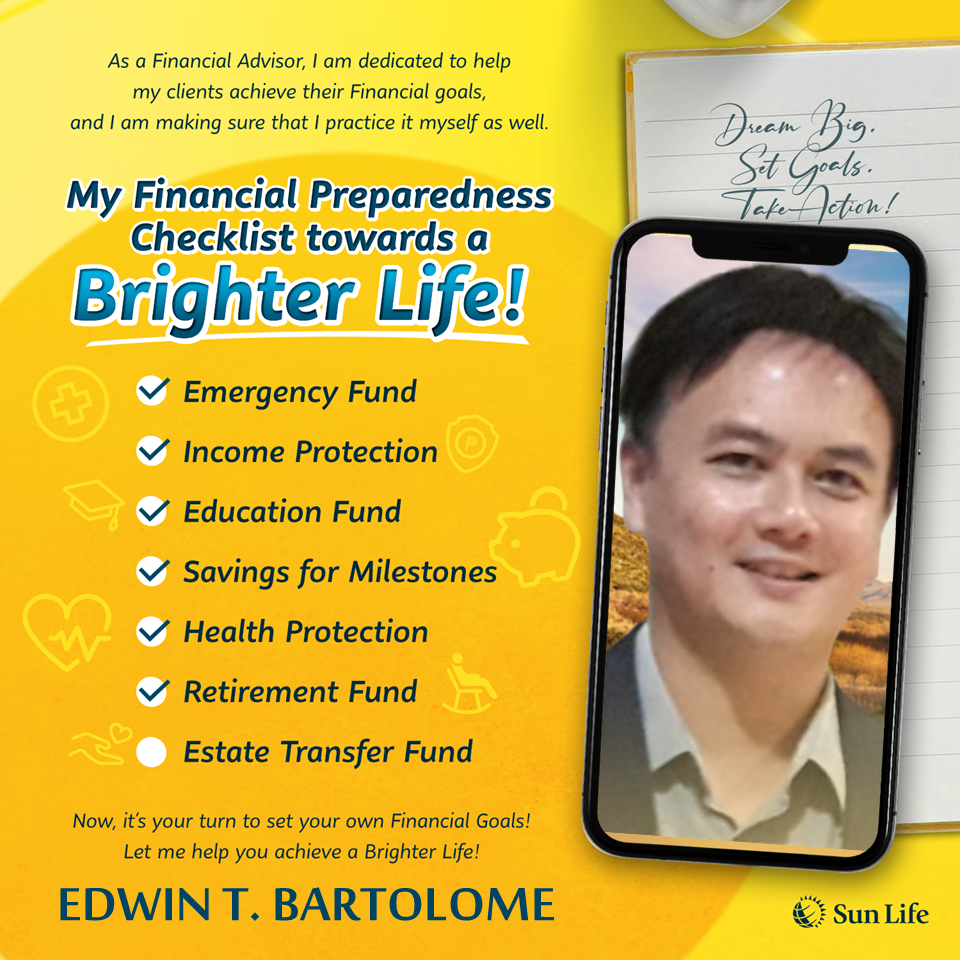

EDWIN T. BARTOLOME

Financial Advisor and Certified Investment Solicitor Authorized by the Insurance Commission to act as an Insurance Agent. For inquiries and free assistance on Personal Finance, Investments, Estate Planning and other Money Matters, you can reach him at: Office Address:

Baobab New Business Office Sun Life Financial 6/F BTTC Centre, 288 Ortigas Avenue Greenhills, San Juan City Philippines Tel. No. 7-719-3958 Fax. No.7-719-3894 |