|

RETIREMENT PLANNING

Retirement Planning is something that many people routinely put off until later in their lives. People in their 20s, 30s and even 40s see retirement as something that's looming very far into the horizon. "There's a lot of time for that", many would say. "65 is still a long way off from where I am today", others reason out.

But in retirement planning, time is considered the most powerful ally. The earlier you decide to start to plan for your retirement, the greater the chances that you will be able to accumulate a stash of cash that would adequately cover your retirement needs and wants. But you'd ask, what are the needs of a retiree? Aren't retirees supposed to be just sitting on their living room couches and watching the TV or listening to the radio all day?

You'd be surprised to realize that most of the things you spend on today will still be needed during retirement. Let's list down the the typical expenses of a retiree.

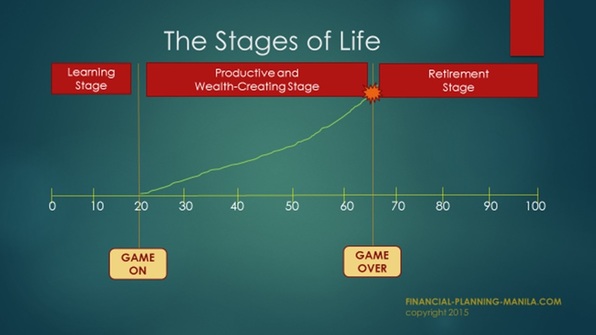

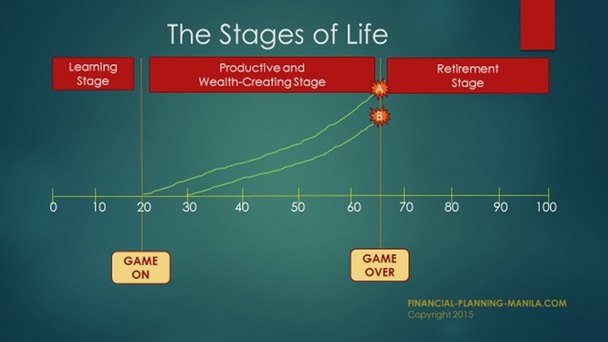

As you can see, life doesn't stop during retirement. But your income and earnings have stopped. Aha! So there is a need for retirement planning simply because during retirement, your EARNING POWER HAS ALREADY ENDED but your EXPENSES CONTINUE. And when retirement time comes, the abovementioned expenses would probably have tripled or grown exponentially from their current levels today. Chances are, you won't be able to adequately meet these expenses even if you regularly place your money in a savings account that earns for you 0.5% to 1% per year. Chances are, you won't even be able to adequately meet these expenses even if you rely on your SSS, GSIS or PAG-IBIG pensions. You have to do more! Apart from saving, you need to INVEST as early as possible so that your money can grow and compound throughout your productive years so that it will become a formidable stash on your 65th birthday. And why should you start as early as possible? Let's take a look at the Stages of our Economic Life for clues as to why retirement planning ought to start as soon as you get your first paycheck. THE STAGES OF OUR ECONOMIC LIFE As you can see, our economic life is divided into three major stages:

The light green line that slowly and steadily grows throughout the Productive and Wealth Creating Stage represents the typical trajectory of the value of the money that people save and invest during this stage. It starts off really slowly during the first few years, normally only gaining momentum during the latter years when investments have already compounded. Notice below what happens when retirement planning is postponed by 10 years. If an individual decides to start saving and investing for retirement at age 30 instead of age 20, the accumulated retirement funds he amasses would only reach Point B on the "Game Over" line, considerably less than Point A, which was the point achieved by someone who started saving and investing a decade earlier. |

"Someone is sitting in the shade today because someone planted a tree a long time ago" Get a

Sun Life Plan for Retirement! Protection for Your Family While Building Up Your Retirement Fund. Learn more HERE! YOUR PARTNER :

Office Address:

Baobab New Business Office Sun Life Financial 6/F BTTC Centre, 288 Ortigas Avenue Greenhills, San Juan City Philippines Tel. No. 7-719-3958 Fax. No.7-719-3894 Edwin T. Bartolome

Financial Advisor and Certified Investment Solicitor Authorized by the Insurance Commission to act as an Insurance Agent. For inquiries and free assistance on Personal Finance, Investments, Estate Planning and other Money Matters, you can reach him at: I want to make a difference. I want to Be A Sun Life Financial Advisor

Financial Planning Articles:

Why You Need To Maintain Both A Savings Account and an Investing Account Why Filipinos Should Invest and Not Merely Save Getting Rich Is Like Running A Marathon, Not A Sprint Delay Your Gratification To Succeed Financially |

|

From the graph above, you see the value of time and what more of it can do to increase your money. So you have do to something about your retirement plans NOW. Do not wait when retirement is staring you at your face.

You owe it to yourself and to your family. |